ICE InsureTech has released its latest case study detailing how the implementation of ICE Claims has delivered positive business improvements for UIA Mutual Insurance (UIA).

ICE Claims has delivered key benefits including:

- Productivity improvements through configurable workflows

- Fast implementation of new affinity schemes

- Flexibility and responsiveness to changes in its business

Jaz Patel, Head of IT UIA, commented, “The ICE Claims implementation phase of our transformation programme has delivered the key criteria to enable us to manage change and reshape our business for the future. ICE Claims has allowed UIA to manage many of the end point integrations and deliver key transformational integrations extremely quickly.”

The full case study can be found in our exclusive content section. To read the case study, click here.

UIA have been so impressed with the successful results from the ICE Claims implementation, they have also selected ICE Policy to replace their existing Policy Administration system, and will become a further full ICE Suite customer.

For more on ICE InsureTech and our product offering, click here.

More articles

The Power of ICE and Publicis Sapient

Imagine real-time, up-to-the-minute customer data – unlocking new opportunities and driving real change. That’s why we’ve partnered with Publicis Sapient, combining our strengths to offer insurers large-scale implementations in weeks, not years.

New Case Study: The Acorn Group’s Growth Mission with ICE

Acorn Group wanted to embark on a transformative journey to support its growth strategy as they scale as a business. ICE Policy has empowered them with a platform that enables Acorn to independently roll products onto ICE.

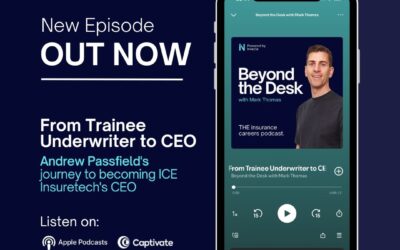

From Trainee Underwriter to CEO: Andrew Passfield’s journey to becoming ICE’s CEO

The latest Beyond the Desk Podcast episode is out! Our CEO, Andrew, joins Mark Thomas to share his incredible journey, from entering the insurance industry with no IT background, to leading an award-winning insurance software company experiencing significant growth....