Stripe are a strategic ecosystem partner with ICE, they offer a suite of APIs powering online payment processing and commerce solutions for internet businesses of all sizes.

Stripe spoke with Al Robertson, chief technology officer at ICE InsureTech, about the role of artificial intelligence in the future of insurance technology, the value of microservices, and how ICE InsureTech is working with Stripe to provide merchant service payments to users.

Q1: What is your team focused on?

We’re working with our very first tier-one insurance client. Our clients are taking upgrades with us all the time and want to evolve their businesses with new features. It takes a lot of effort to implement these innovations and there’s a plethora of other new features that we’re adding and expanding on for all our clients. We recently upgraded our client Ticker onto the latest version of ICE Policy. We launched Ticker to market in early 2019 and since then we have worked together on regular upgrades. Ticker is the prime example of the benefits of consistent upgrades with the latest functionality available, tailored to delivering against new industry demands.

Q2: Where is insurance tech headed?

We’ll soon see a lot of niche insurance companies emerge. And companies like us will find new ways to integrate with specialty companies to provide an even richer ecosystem for our clients.

There have been huge advances in AI and machine learning and businesses are already embedding these tools into their core platforms. That is where we’re going to see the future really change. Another aspect is that everything in the insurance space is becoming digital. Insurance providers who want to be here in 10 years must provide a full-cycle digital offering, from offering quotes and making midterm adjustments to cancelling and renewing online.

To read the full Stripe interview, please click below.

Merchant Services Integration Eco-partner

Case Study: Stripe

More articles

The Power of ICE and Publicis Sapient

Imagine real-time, up-to-the-minute customer data – unlocking new opportunities and driving real change. That’s why we’ve partnered with Publicis Sapient, combining our strengths to offer insurers large-scale implementations in weeks, not years.

New Case Study: The Acorn Group’s Growth Mission with ICE

Acorn Group wanted to embark on a transformative journey to support its growth strategy as they scale as a business. ICE Policy has empowered them with a platform that enables Acorn to independently roll products onto ICE.

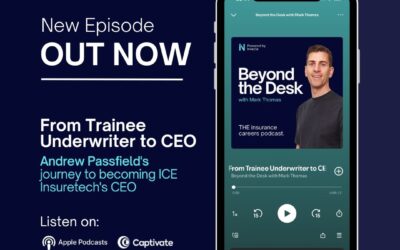

From Trainee Underwriter to CEO: Andrew Passfield’s journey to becoming ICE’s CEO

The latest Beyond the Desk Podcast episode is out! Our CEO, Andrew, joins Mark Thomas to share his incredible journey, from entering the insurance industry with no IT background, to leading an award-winning insurance software company experiencing significant growth....