The insurance industry is evolving at a fast pace in the wake of challenges and opportunities put forward by changing customer demands, compliance requirements, proliferation of digital devices, enhanced connectivity, and others.

ICE InsureTech held an interview with Craig Beattie – Celent’s Senior Insurance Analyst – and created an exclusive report on the Case for a New Modern System.

The report addresses the key insurance technology questions:

- What key trends are driving digital insurance?

- How are these manifesting in insurance?

- What does this mean to the business case?

The Case for a New Modern System

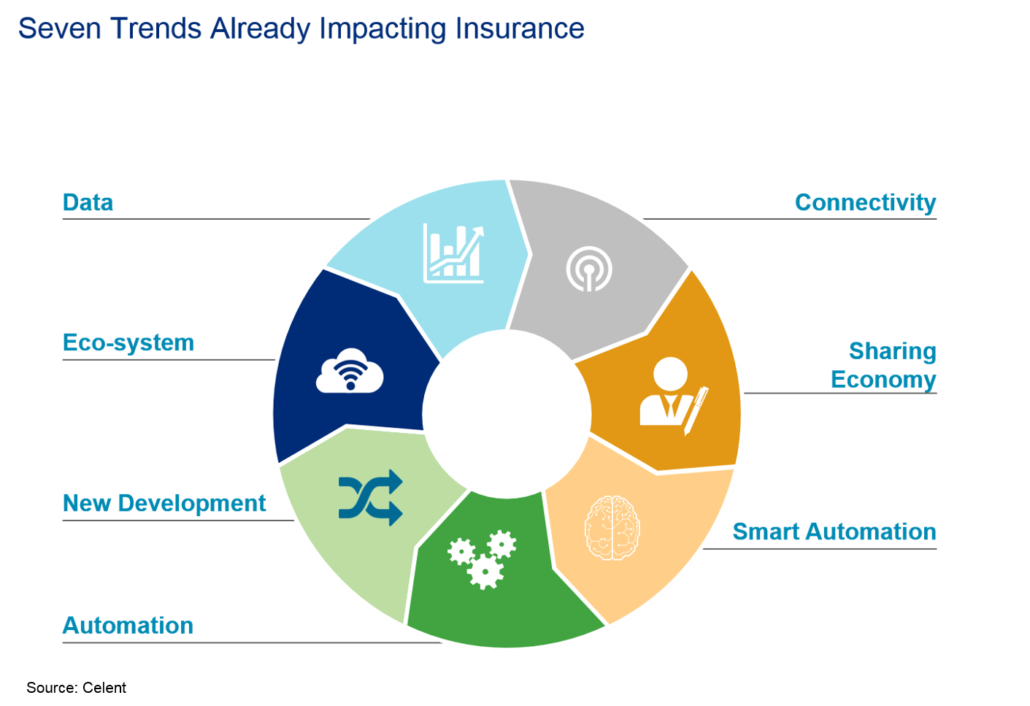

In this report, Celent makes the case that there are seven trends impacting the insurance industry that both enable, and drive the need for, a new modern system at the heart of an insurer. Here we distinguish a new modern system from those that emerged over a decade ago.

These trends are enabling new propositions in the industry such as IoT enabled products, as well as new solutions to old problems with adaptive systems responding to partners and customers changing needs.

These new possibilities and capabilities require some thought to be given to the business case. The benefits covered in a similar report conducted by Celent, nearly 10 years ago (2008) still stand but new sources of benefits are presented making the case for a new modern system.

Celent describes the key differences between a modern system and a new modern system as capabilities in new delivery of the systems as well as the ability to incorporate small or micro-integrations with new services, new automatics techniques and new data.

The ICE Insurance suite has the power of next-generation processing that digitises the way claims and policies are handled. ICE can enable organisations to increase strategic capability, flex propositions to meet market demands and significantly reduce costs.

How ICE InsureTech can help

At ICE, we provide integrated technologies that connect people, devices and systems within the insurance sector.

Our solutions deliver a fast return on investment, are easy to implement and can help you to meet the ever-increasing demands of today’s insurance customers.

For more information, contact ICE InsureTech

More articles

New Case Study: The Acorn Group’s Growth Mission with ICE

Acorn Group wanted to embark on a transformative journey to support its growth strategy as they scale as a business. ICE Policy has empowered them with a platform that enables Acorn to independently roll products onto ICE.

From Trainee Underwriter to CEO: Andrew Passfield’s journey to becoming ICE’s CEO

The latest Beyond the Desk Podcast episode is out! Our CEO, Andrew, joins Mark Thomas to share his incredible journey, from entering the insurance industry with no IT background, to leading an award-winning insurance software company experiencing significant growth....

Proud to Be Certified: ICE is a Great Place to Work®

ICE InsureTech, a leading provider of insurance software platforms, is thrilled to announce its UK certification as a “Great Place to Work” by the globally recognised Great Place to Work® Institute.